The Definitive Guide to Transaction Advisory Services

Table of ContentsGet This Report about Transaction Advisory ServicesFacts About Transaction Advisory Services UncoveredThings about Transaction Advisory ServicesThe Single Strategy To Use For Transaction Advisory ServicesThe 6-Minute Rule for Transaction Advisory Services

This step makes certain the company looks its ideal to potential buyers. Getting the service's worth right is important for an effective sale.Purchase experts action in to aid by obtaining all the needed info arranged, answering concerns from buyers, and setting up visits to the service's place. Transaction consultants use their expertise to aid business owners take care of challenging settlements, satisfy purchaser expectations, and framework offers that match the owner's objectives.

Meeting lawful regulations is important in any business sale. Transaction consultatory services collaborate with legal experts to create and assess contracts, contracts, and various other legal documents. This reduces risks and sees to it the sale complies with the regulation. The duty of deal advisors prolongs beyond the sale. They assist local business owner in preparing for their following steps, whether it's retired life, starting a brand-new endeavor, or managing their newfound wide range.

Transaction consultants bring a wide range of experience and knowledge, ensuring that every aspect of the sale is managed properly. Through tactical prep work, assessment, and negotiation, TAS helps company owner achieve the highest possible price. By making sure legal and regulative conformity and handling due diligence along with various other deal team participants, transaction consultants decrease possible risks and obligations.

6 Simple Techniques For Transaction Advisory Services

By contrast, Big 4 TS groups: Work with (e.g., when a possible buyer is carrying out due persistance, or when a bargain is closing and the customer needs to integrate the company and re-value the seller's Balance Sheet). Are with fees that are not connected to the deal shutting efficiently. Gain charges per involvement somewhere in the, which is less than what investment financial institutions earn even on "little bargains" (yet the collection chance is also a lot higher).

The interview questions are very comparable to financial investment financial interview questions, however they'll concentrate extra on bookkeeping and valuation and much less on subjects like LBO modeling. For example, anticipate inquiries regarding what the Modification in Working Capital means, EBIT vs. EBITDA vs. Web Earnings, and "accounting professional only" subjects like test balances and just how to stroll with events using debits and debts instead of financial declaration modifications.

The Facts About Transaction Advisory Services Uncovered

that demonstrate how both metrics have altered based upon items, networks, and customers. to judge the accuracy of monitoring's previous forecasts., consisting of aging, inventory by product, ordinary degrees, and arrangements. to determine whether they're totally imaginary or rather credible. Specialists in the TS/ FDD teams might additionally talk to management regarding whatever above, and they'll compose an in-depth report with their findings at the end of the process.

The pecking order in Deal Services differs a little bit from the ones in financial investment financial and personal equity professions, and the general shape looks like this: The entry-level duty, where you do a whole lot of information and economic evaluation (2 years for a promo from right here). The following level up; similar work, yet you get the more interesting little bits (3 years for a promotion).

Specifically, it's hard to get advertised beyond the Supervisor level because couple of people leave the work at that stage, and you need to begin showing proof of your ability to create earnings to breakthrough. Allow's begin with the hours and way of living since those are much easier to describe:. There are occasional late nights and weekend break job, however absolutely nothing like the frenzied nature of financial investment banking.

There are cost-of-living changes, so anticipate reduced payment if you're in a cheaper place outside significant economic facilities. For all positions other than Companion, the base pay makes up the bulk of the complete compensation; the year-end benefit could be a max of 30% of your base wage. Often, the most effective means to increase your revenues is to switch over to a various firm and negotiate for a greater salary and perk

The Best Guide To Transaction Advisory Services

You might get involved in company advancement, yet investment financial gets harder at this stage due to the fact that you'll be over-qualified for Analyst functions. Company money is go still a choice. At this phase, you should just remain and make a run for a Partner-level role. If you wish to leave, possibly transfer to a client and execute their evaluations and due persistance in-house.

The primary issue is that because: You typically require to join one more Large 4 team, such as audit, and work there for a few years and after that relocate right into TS, job there for a few years and then move into IB. And there's still no warranty of winning this IB function because it depends on your area, customers, and the hiring market at the time.

Longer-term, there is additionally some threat of and because reviewing a firm's historical economic info is not precisely rocket scientific research. Yes, humans will always require to be entailed, however with advanced modern technology, reduced head counts can potentially support client engagements. That claimed, the Purchase Providers team defeats audit in regards to pay, job, and departure chances.

If you liked this short article, you could be curious about analysis.

Some Known Details About Transaction Advisory Services

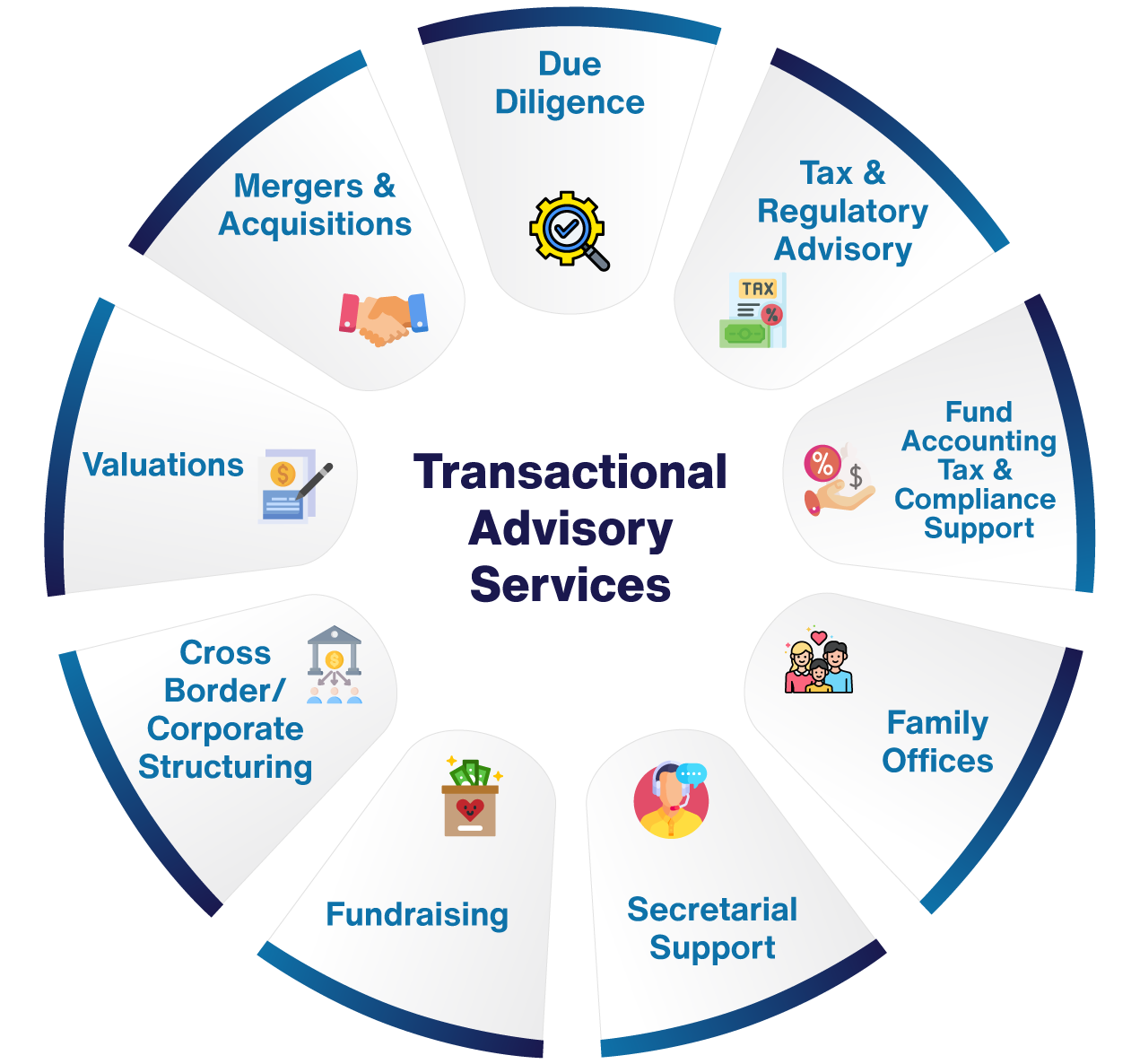

Create advanced economic structures that help in identifying the actual market worth of a company. Offer consultatory operate in connection to organization assessment to help find in bargaining and pricing structures. Explain one of the most appropriate type of the bargain and the kind of consideration to utilize (cash money, stock, earn out, and others).

Create action strategies for danger and direct exposure that have been recognized. Carry out assimilation planning to figure out the process, system, and organizational modifications that may be called for after the deal. Make numerical estimates of integration costs and benefits to assess the economic rationale of assimilation. Establish guidelines for integrating divisions, innovations, and company processes.

Identify prospective reductions by minimizing DPO, DIO, and DSO. Assess the possible client base, market verticals, and sales cycle. Consider the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence uses essential understandings right into the performance of the company to be acquired concerning danger evaluation and value creation. Determine short-term adjustments to financial resources, banks, and systems.